September 2022 Self-Storage National Report

Self-Storage Properties Attract Broadening Range of Capital; Sector Durability and Inflation Resistance Key

Storage space demand sustains momentum, extends rent climb.

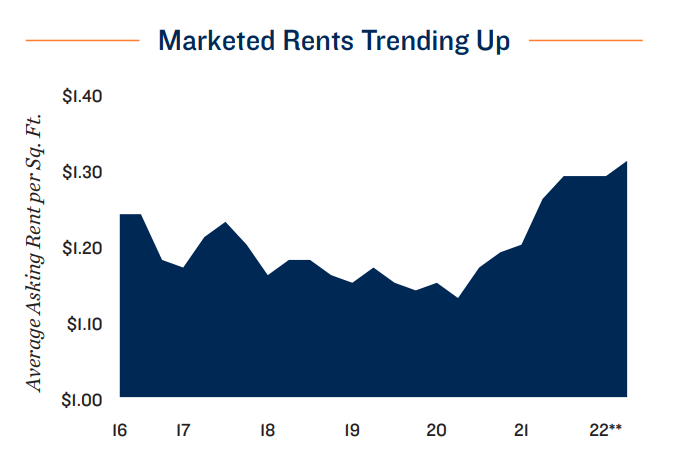

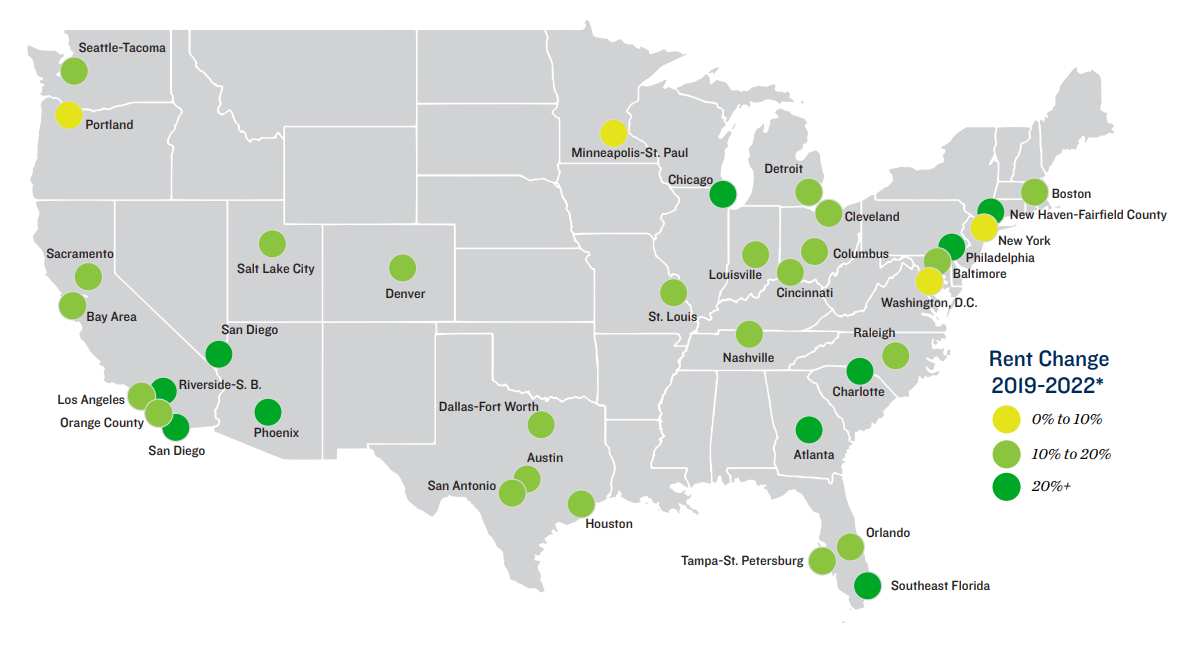

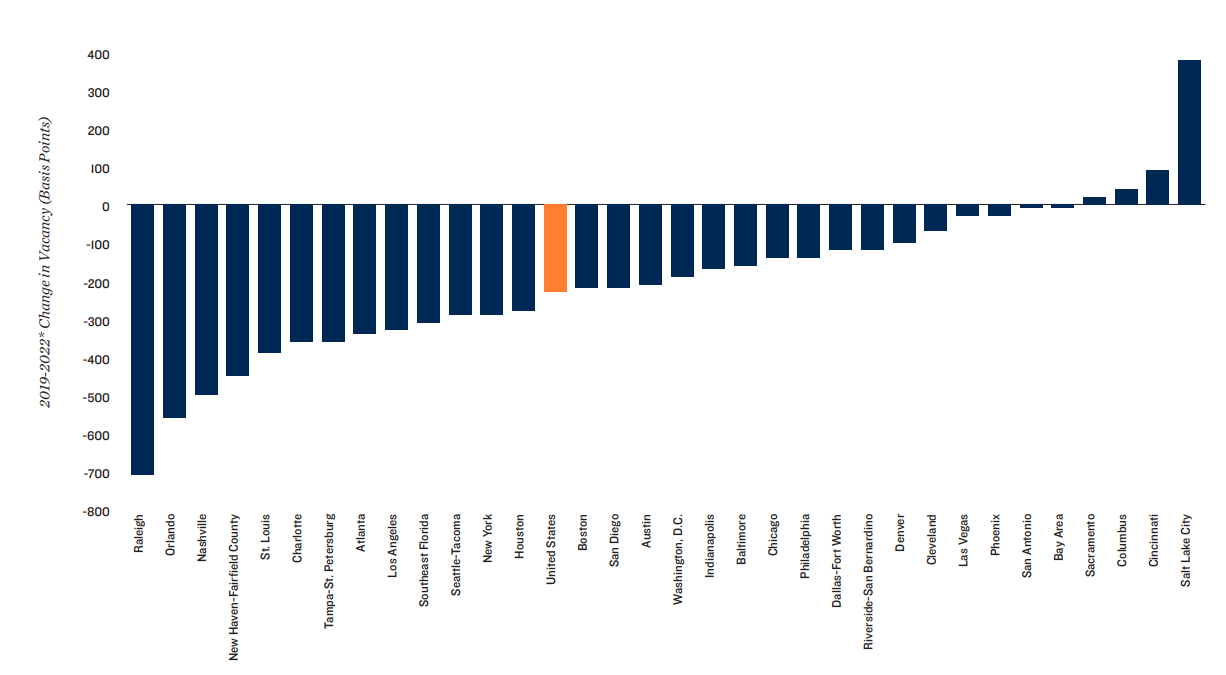

The self-storage sector entered the second half of the year in a strong position, having accumulated additional renter demand during the most challenging period of the pandemic. As health conditions and social behaviors normalize, the sector is continuing to outperform previous cycles. The average asking rent for a standard 10-foot by 10-foot unit in June was up 15 percent compared to the end of 2019. Over that same span, vacancy contracted 190 basis points to 6.6 percent. In the preceding four years, rents had receded 8 percent, while availability averaged 9.5 percent. Properties have benefited from more prevalent remote work, as well as ongoing population growth and migration. While some of the pandemic specific demand factors are dissipating, these other demographic trends will continue to support the sector.

Relocations spur notable growth in smaller markets.

More than half of the millennial generation is now over the age of 30, a milestone association with growing households. This is spurring relocation activity as members of this cohort pursue larger residences in metros with comparatively lower costs of living. Many baby boomers have also reached retirement ages, with the transition to a fixed income encouraging moves to locales with lower tax burdens. While historically a selection of secondary metros have been the most prominent targets of migration, high localized inflation from recent rapid population growth has now prompted a broader consideration of markets. Robust in-migration has already propelled rents in satellite metros, such as Tucson and Fayetteville, by double the national pace.

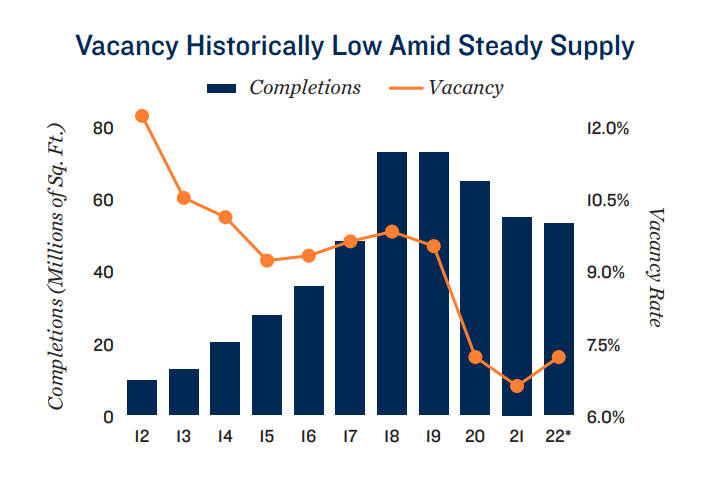

Tempered construction activity benefiting sector.

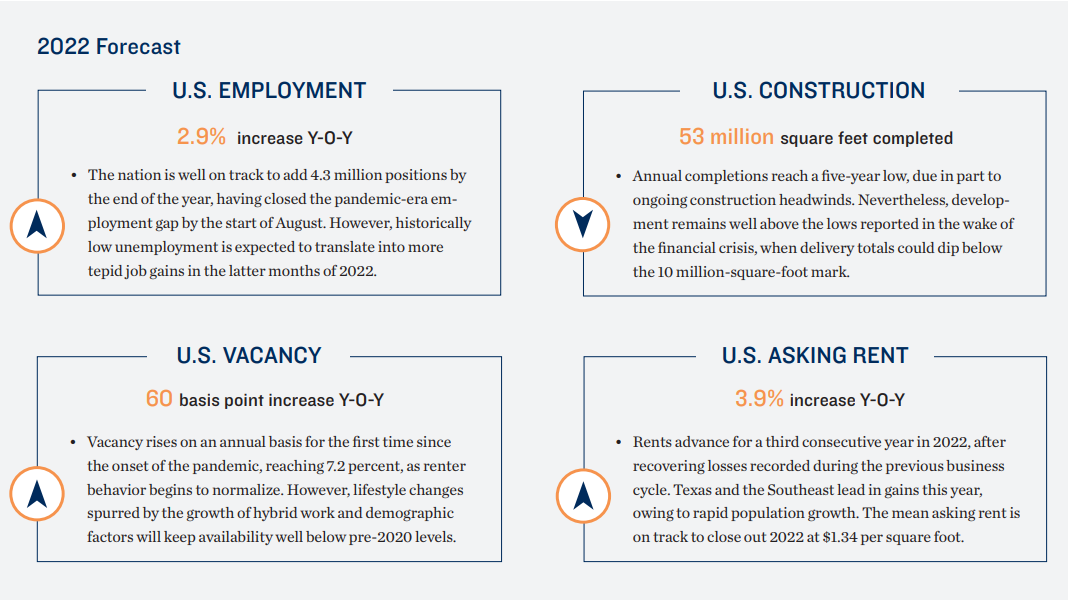

Prior to the health crisis, builders were finalizing new space at a record clip, with 150 million square feet completed between 2018 and 2019. However, since the onset of the pandemic, deliveries have consistently slowed on an annual basis. Developers opened roughly 45.2 million square feet during the trailing year ended in June, the slowest 12-month span for construction reported since 2017. While a notable amount of projects in the planning or proposal stages indicates abundant developer interest, labor and materials shortages are still ongoing, complicating the completion of projects still underway. Although today's narrowing supply pipeline is welcome news for existing facilities, a future increase in deliveries could join other potential headwinds in the future to challenge the property type.

Sector's counter-cyclical factors may be put to the test.

While self-storage properties have performed commendably during the pandemic, softening consumer sentiment - due to elevated inflation and higher interest rates - could impact demand in the near future. Fewer new possessions and higher expenses may prompt some storage renters to end leases. In the event of a recessionary period, however, the sector boasts some counter-cyclical factors that could act as a backstop for storage renting. In an economic slowdown or downturn, many households may consolidate to mitigate expenses. These tighter living conditions may translate to increased storage usage from some individuals. Major life events, which are unrelated to the business cycle, can also lead to additional storage needs.

Market Trends

Broad Based Rent Gains Favor Sector

Vast Majority of Metros Sustain Historically Tight Vacancy

Investor Appetites Ample, Despite Capital Market Headwinds

Investor Appetites Ample, Despite Capital Market Headwinds

Robust segment performance generates record deal flow.

The number of trades completed during the 12-month period ended in June eclipsed the pre-pandemic record by more than 70 percent. While transaction activity peaked at record levels in the second half of 2021, sales velocity through the first half of this year is still well above historical averages. Even as interest rates began to climb in March, increasing capital costs, transactions actually rose between the first and second quarters. While this indicates substantial investor enthusiasm, the Federal Reserve is expected to hike rates multiple times before the end of 2022, possibly dampening for deal flow.

Potential inflation resistance aids high trade totals.

Elevated transaction velocity is being supported by a broader buyer pool, with investors engaged by the sector's potential inflation resistance and countercyclical renter demand factors. Most self-storage units are leased on a monthly basis, allowing rents to be adjusted more frequently than in other property types. While the inconsistent rate environment is prompting some larger parties to delay acquisitions, robust fundamentals have kept private buyers energized.

Significant cap rate compression could impact investment landscape.

Segment yields have dropped notably on the national level since the onset of the pandemic, declining from the mid-6 zone in late 2019 to the mid-5 percent tranche as of April 2022. Buyers seeking higher yields to compensate for steeper borrowing costs may seek out opportunities in outlying suburbs or tertiary markets with higher growth potential for elevated returns.

Strong Job Growth Dispels Some Economic Worries, Providing Ammunition for Further Fed Rate Increases

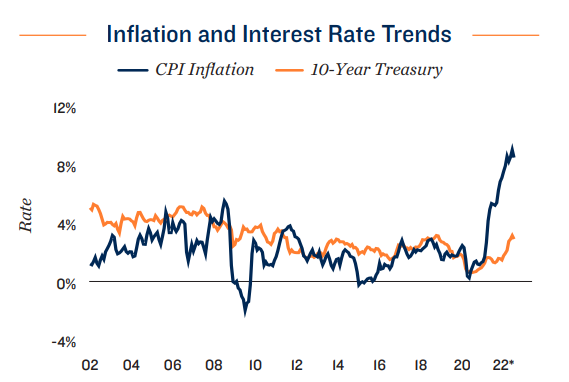

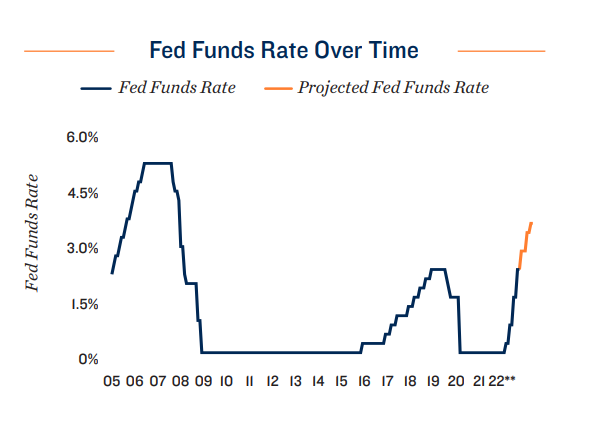

Fed continues rate hike plan as signs of decelerating inflation start to emerge.

Elevated inflation since the spring of 2021 has motivated the Federal Reserve to substantially tighten monetary policy this year through a combination of higher interest rates and balance sheet reductions. Year-to-date through July, the Fed has raised the overnight lending rate by a collective 225 basis points, putting the target measure at a 2.25 percent lower bound. The corresponding upward impact to interest rates may now be having an effect. After climbing by 9.1 percent year-over-year in June, the Consumer Price Index advanced by a slightly slower 8.5 percent yearlong pace in July. At the same time, July's employment gain well surpassed initial expectations, as 528,000 jobs were created in the month. With more than 3 million positions added so far this year, the economy appears to have ample positive momentum, despite

posting two consecutive quarters of GDP contraction. The labor market's strength will likely give the Federal Open Market Committee (FOMC) sufficient confidence to hike the federal funds rate multiple more times this year, to bring the lending rate over the 3 percent mark by the start of 2023. While the FOMC believes it has sufficient margin to increase capital costs without substantially eroding the employment situation, other factors are creating headwinds. Supply chains continue to be beleaguered, with the war in Ukraine having an ongoing impact on the global energy and food markets.

Lenders and investors adapting to higher interest rates.

Capital remains widely available for self-storage investment transactions, as made evident by accelerated deal velocity in the second quarter. The sector's recent historical marks in vacancy and rent growth, as well as its monthly lease structure, are viewed favorably by financiers, especially given elevated inflation. Nevertheless, capital costs are climbing, impacting terms. Banks, ranging from local to national in scope, continue to be the most active lenders in the space, but are likely to favor borrowers with whom they have an established relationship with. The owner-user structure common in many privately owned self-storage properties may also align more with bank and credit union preferences in the event of an economic slowdown. Lenders have generally tightened underwriting criteria, with individual asset quality and location continuing to be differentiating factors. Financiers are placing more emphasis on debt service coverage, looking for debt coverage ratios above 1.2 percent, equating to lower loan-to-value ratios at or under 60 percent. Bridge financing is accessible for greater leverage, at higher rates.